Tritium Reports Record Sales, Revenue, and Backlog for 2022 Calendar Year

BRISBANE, Australia, March 9, 2023 – Tritium DCFC Limited (Nasdaq: DCFC) (“Tritium” or the “Company”), a global developer and manufacturer of direct current (“DC”) fast chargers for electric vehicles (“EVs”), today announced record sales orders, record revenue, and record backlog for the Company’s 2022 calendar year, and released financial statements for the six-month period ended December 31, 2022.

Calendar Year 2022 Results

- Received record sales orders valued at $195 million in calendar year 2022, representing an increase of 38% over the previous calendar year’s result of $141 million

- Achieved record revenue of $102 million in calendar year 2022, at the high-end of the previously announced range of $95 – $102 million, of which $73 million was achieved in the six months ended December 31, 2022, a 27% increase over the results of the corresponding six-month period ended December 31, 2021

- Cash and cash equivalents of $69 million as at December 31, 2022

- Achieved a record purchase order backlog of approximately $159 million at December 31, 2022

Second Half 2022 Calendar Year Results

- Achieved record backlog and revenue in the second half of the 2022 calendar year

- Had backlog of $159 million at December 31, 2022, and achieved revenue of $73 million for the six-month period ended December 31, 2022, representing increases of 115% and 27%, respectively, compared to the same period in the 2021 calendar year

- Gross margin was -9.7% for the six-month period ended December 31, 2022, which is reflective of ramp-up costs while the Company invested in and opened its new Tennessee factory and is expected to normalize over the course of calendar year 2023, particularly in the second half

- December 31, 2022, Tritium reported $69 million in cash and cash equivalents and $107 million in raw materials and finished goods inventory

- Net comprehensive loss was $56 million for the six-month period ended December 31, 2022, a 17% improvement from the corresponding prior six-month period ended December 31, 2021

“We remain focused on our goal of becoming the number one global manufacturer of electric vehicle fast chargers,” said Tritium CEO Jane Hunter. “We invested in a US factory earlier than our competitors and on a bigger scale. We expect our Tennessee factory to become our global revenue engine, in part by unlocking the benefits of the US government’s $7.5 billion of funding for EV chargers and maintenance, which requires domestically built charging equipment and will ultimately require more than 55% locally sourced components. Our new factory started shipping products to customers in August 2022 and, with the recent announcement of the final Build America, Buy America guidelines for the NEVI program, we believe Tritium has a major head start and a leading position in supplying fast chargers for the US through what we expect will soon be the highest capacity fast charger factory in the country.”

2023 Calendar Year Guidance

- Tritium reaffirms expected revenue for the 2023 calendar year in excess of $200 million, corresponding to annual growth of over 100%, and reaffirms the timeline with approximately 35% forecast for the first half of the 2023 calendar year and the balance in the second half of the 2023 calendar year

- Tritium expects gross margin to improve to between 10% and 12% for calendar year 2023, particularly through the second half as the Tennessee factory starts to hit scaled production targets and the manufacturing overhead associated with a greenfield facility is absorbed. The Company will also benefit from lower cost freight routes from the East Coast of the US to Europe, delivering stock via truck instead of air or sea to North America, as well as price increases implemented in the 2022 calendar year, which require backlog builds to be completed to be fully realized

- Tritium expects to become EBITDA positive during the first half of the 2024 calendar year

Tritium continues to see strong customer growth, with increasing orders from charge point operators, fleets, utilities, and the fuel and convenience segments, many of which have shared public plans to install tens of thousands of electric charging stations over the next five years.

“Our results in the second half of 2022 demonstrate the strength of Tritium’s position in the global fast charging market as we address the demands of the growing electric vehicle industry,” said Tritium CFO Rob Topol. “With our new state-of-the-art Tennessee factory coming online and increasing production capacity, we are confident that Tritium will continue to be a leader in the global transition to electric mobility and drive sustainable change for a cleaner and greener future.”

In support of this accelerating demand from new and existing customers for Tritium’s fast chargers, the Company expects to scale the Tennessee factory to five production lines and two shifts on two of those lines by the end of the 2023 calendar year. Through this production ramp, the Company expects to produce a total of 11,000 units for the 2023 calendar year and projects global annualized production rates of 16,000 units by December 2023 and 28,000 units by December 2024. Tritium believes the Company’s planned US production capacity remains the highest of any publicly announced DC fast charger manufacturer in the US.

Based on management estimates, at December 31, 2022 Tritium believes it held the #1 universal fast charger market share in the US, Australia, and New Zealand, and the #3 position across Europe.

About Tritium

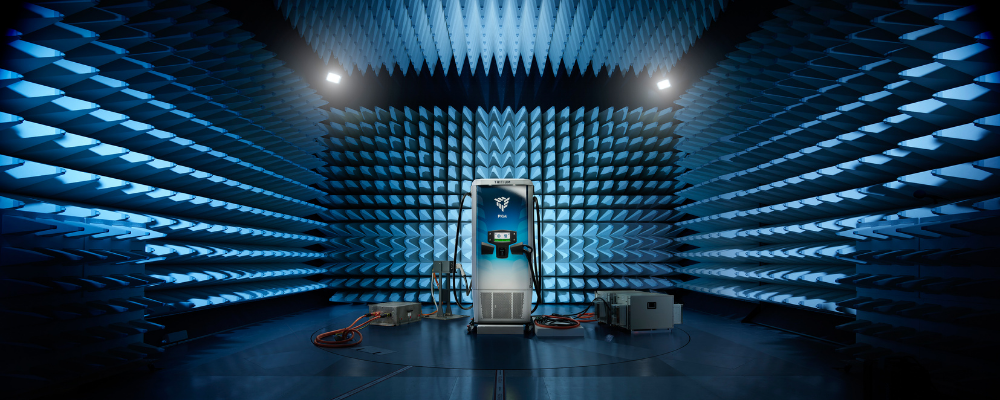

Founded in 2001, Tritium (NASDAQ: DCFC) designs and manufactures proprietary hardware and software to create advanced and reliable DC fast chargers for electric vehicles. Tritium’s compact and robust chargers are designed to look great on Main Street and thrive in harsh conditions, through technology engineered to be easy to install, own, and use. Tritium is focused on continuous innovation in support of our customers around the world.

For more information, contact us.

Presentation of Information

Unless otherwise indicated, references to a particular “fiscal year” are to our fiscal year ended June 30 of that year. References to a year other than a “fiscal” or “fiscal year” are to the calendar year ended December 31.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, also known as the Private Securities Litigation Reform Act of 1995. Any express or implied statements contained in this press releasethat are not statements of historical fact and generally relate to future events, hopes, intentions, strategies, or performance may be deemed to be forward-looking statements. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “might,” “possible,” “believe,” “predict,” “potential,” “continue,” “aim,” “strive,” and similar expressions may identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expressed or implied forwarding-looking statements, including, but not limited to: our history of losses; the ability to successfully manage our growth; the adoption and demand for electronic vehicles including the success of alternative fuels, changes to rebates, tax credits and the impact of government incentives; the accuracy of our forecasts and projections including those regarding our market opportunity; competition; our ability to secure financing; delays in our manufacturing plans; losses or disruptions in supply or manufacturing partners; risks related to our technology, intellectual property and infrastructure; exemptions to certain U.S. securities laws as a result of our status as a foreign private issuer; and other important factors discussed under the caption “Risk Factors” in the Company’s prospectus filed pursuant to Rule 424(b)(3) filed with the Securities and Exchange Commission (the “SEC”) on August 30, 2022, as such factors may be updated from time to time in the Company’s other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investors Relations section of Company’s website at https://investors.tritiumcharging.com/. Any investors should carefully consider the risks and uncertainties described in the documents filed by the Company from time to time with the SEC as most of the factors are outside the Company’s control and are difficult to predict. As a result, the Company’s actual results may differ from its expectations, estimates and projections and consequently, such forward-looking statements should not be relied upon as predictions of future events. The Company cautions not to place undue reliance upon any forward-looking statements, including projections, which speak only as to management expectations and beliefs as of the date they are made. The Company disclaims any obligation or undertaking to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law.

No Offer

This press release is for informational purposes only and it does not represent an offer to sell or the solicitation of an offer to buy any of the Company’s securities. There will be no sale of the Company’s securities in any jurisdiction in which one would be unlawful.

Condensed Consolidated Statements of Operations and Comprehensive Loss

For the six months ended December 31, (unaudited)

| Six months to December 31, 2022 $’000 | Six months to December 31, 2021 $’000 | |

|---|---|---|

| Revenue | ||

| Service and maintenance revenue – external parties | 4,376 | 2,405 |

| Hardware revenue – external parties | 66,579 | 41,952 |

| Hardware revenue – related parties | 1,588 | 12,629 |

| Software revenue | 101 | 5 |

| Total revenue | 72,644 | 56,991 |

| Cost of goods sold | ||

| Service and maintenance – costs of goods sold | (1,770) | (1,962) |

| Hardware – cost of goods sold | (77,919) | (51,495) |

| Total cost of goods sold | (79,689) | (53,457) |

| Selling, general and administration expense | (36,437) | (46,851) |

| Product development expense | (7,114) | (6,521) |

| Foreign exchange gain/(loss) | 102 | 152 |

| Total operating costs and expenses | (43,449) | (53,220) |

| Loss from operations | (50,494) | (49,686) |

| Other income (expense), net: | ||

| Finance costs | (15,471) | (11,581) |

| Transaction and offering related fees | – | (640) |

| Fair value movements – warrants and derivative | 9,607 | (6,282) |

| Other income | 87 | 51 |

| Total other expense | (5,777) | (18,452) |

| (Loss) before income taxes | (56,271) | (68,138) |

| Income tax expense | – | – |

| Net (loss) | (56,271) | (68,138) |

| Net (loss) per common share | ||

| Net (loss) attributable to common shareholders | (56,271) | (68,138) |

| Basic and diluted – common shares | (0.37) | (0.63) |

| Basic and diluted – class C shares | – | (0.63) |

| Weighted average shares outstanding | ||

| Basic and diluted – common shares | 153,454,231 | 99,915,539 |

| Basic and diluted – class C shares | – | 8,047,417 |

| Comprehensive Loss | ||

| Net (loss) | (56,271) | (68,138) |

| Other income (loss) (net of tax) | ||

| Change in foreign currency translation adjustment | (435) | 2,550 |

| Total other comprehensive income (loss) (net of tax) | (435) | 2,550 |

| Total comprehensive (loss) | (56,706) | (65,588) |

Condensed Consolidated Statements of Financial Position

As at December 31, (unaudited)

| As of December 31, 2022 $’000 | As of June 30, 2022 $’000 | |

|---|---|---|

| Assets | ||

| Cash and cash equivalents | 68,551 | 70,753 |

| Accounts receivable – related parties | 183 | 16 |

| Accounts receivable – external parties | 59,960 | 30,816 |

| Accounts receivable – allowance for expected credit losses | (743) | (275) |

| Inventory | 106,858 | 55,706 |

| Prepaid expenses | 2,666 | 4,873 |

| Deposits | 25,586 | 15,675 |

| Total current assets | 263,061 | 177,564 |

| Property, plant and equipment, net | 15,031 | 11,151 |

| Operating lease right of use assets | 20,183 | 24,640 |

| Total non-current assets | 35,214 | 35,791 |

| Total Assets | 298,275 | 213,355 |

| Liabilities and Shareholders’ Deficit | ||

| Accounts Payable | 101,379 | 47,603 |

| Borrowings | 904 | 74 |

| Related party borrowings | 19,661 | – |

| Contract liabilities | 70,017 | 37,727 |

| Employee benefits | 2,692 | 2,653 |

| Other provisions | 2,246 | 27,623 |

| Obligations under operating leases | 2,995 | 4,020 |

| Warrants | 10,050 | 12,340 |

| Other current liabilities | 1,602 | 2,939 |

| Total current liabilities | 211,546 | 134,979 |

| Obligations under operating leases | 22,974 | 25,556 |

| Contract liabilities | 2,776 | 2,231 |

| Employee benefits | 295 | 217 |

| Borrowings net of unamortized issuance costs | 135,873 | 88,269 |

| Related party borrowings | 8,988 | – |

| Other provisions | 3,069 | 2,652 |

| Total non-current liabilities | 173,975 | 118,925 |

| Total Liabilities | 385,521 | 253,904 |

| Commitments and Contingent liabilities | – | |

| Shareholders’ Deficit | ||

| Common shares, no par value, unlimited shares authorized at December 2022 and June 2022, 156,310,918 shares issued as of December 2022 (153,094,269 as of June 2022), 156,310,918 shares outstanding as of December 2022 (148,893,898 shares outstanding as of June 2022) | 237,779 | 227,268 |

| Treasury shares, 3,015,188 as of December 2022 (4,200,371 as of June 2022) | – | |

| Additional paid in capital | 18,708 | 19,210 |

| Accumulated other comprehensive income | 3,205 | 3,640 |

| Accumulated deficit | (346,938) | (290,667) |

| Total Shareholders’ deficit | (87,246) | (40,549) |

| Total Liabilities, and Shareholders’ Deficit | 298,275 | 213,355 |

Condensed Consolidated Statements of Cash Flows

For the six months ended December 31, (unaudited)

| Six months to December 31, 2022 $’000 | Six months to December 31, 2021 $’000 | |

|---|---|---|

| Cash flows from operating activities | ||

| Net loss | (56,271) | (68,138) |

| Reconciliation of net loss to net cash used in operating activities | ||

| Adjustments for non-cash items | ||

| Share-based employee benefits expense | 5,435 | 28,912 |

| Foreign exchange gains or losses | (364) | (152) |

| Depreciation expense | 1,100 | 669 |

| Fair value movements – warrants and derivative | (9,607) | 6,282 |

| Capitalized interest | 6,942 | 10,885 |

| Non-cash transaction costs on financing facility | 841 | – |

| Changes in operating assets and liabilities | ||

| Accounts receivable | (28,843) | (35,475) |

| Inventory | (51,152) | 1,888 |

| Accounts payable | 32,014 | 23,007 |

| Employee benefits | 117 | (12,459) |

| Other liabilities | 24,293 | 28,330 |

| Other assets | (3,218) | (7,733) |

| Net cash used in operating activities | (78,711) | (23,984) |

| Cash flows from investing activities | ||

| Payments for property, plant and equipment | (4,944) | (2,576) |

| Net cash used in investing activities | (4,944) | (2,576) |

| Cash flows from financing activities | ||

| Proceeds from borrowings – external parties | 150,000 | 28,645 |

| Proceeds from borrowings – related parties | 30,000 | – |

| Proceeds from convertible notes including derivative | – | 73 |

| Repayment of borrowings – external parties | (95,205) | (10) |

| Repayment of borrowings – related parties | (45) | – |

| Transaction costs for borrowings | (5,841) | — |

| Net cash provided by financing activities | 78,909 | 28,708 |

| Effects of exchange rate changes on cash and cash equivalents | 2,544 | (3) |

| Net increase (decrease) in cash and cash equivalents | (4,746) | 2,148 |

| Cash and cash equivalents at the beginning of the period | 70,753 | 6,157 |

| Cash and cash equivalents at the end of the period | 68,551 | 8,302 |

Supplemental information to the condensed consolidated statement of cash flows:

| Classification | Description | Six months to December 31, 2022 $’000 | Six months to December 31, 2021 $’000 |

|---|---|---|---|

| Operating | Cash paid for interest, net of amounts capitalised | 7,962 | 2,238 |

| Investing | Non-cash movements in relation to property, plant and equipment | 256 | – |

| Investing | Non-cash movement in relation to Right of Use Assets | (96) | 210 |

| Investing | Cash paid in relation to lease liabilities | 1,755 | 1,497 |

| Financing | Cashless conversion of warrants into common shares | 3,022 | – |

###

Media Contact

Jack Ulrich

[email protected]

Investor Contact

Cary Segall

[email protected]