Tritium Announces Largest Customer Order in Company History and Releases Preliminary Results for CY2022 with Record Sales, Revenue, and Backlog

Financial information at and for the period ended December 31, 2022 presented herein is preliminary. Complete financial results for the period will be published by the Company on Form 6-K within the standard timeframes prescribed by applicable SEC and exchange rules.

Highlights

- Secured the largest order from a single customer in Company history with a new order from bp (NYSE: BP) for deployment across the United States, United Kingdom, Europe, and Australia.

- Achieved the largest monthly production output in Company history in December 2022, with 50% more output than any previous month.

Calendar Year 2022 – Preliminary Results

- Received record sales orders valued at $195 million in calendar year 2022, growth of 38% over the previous calendar year’s result of $141 million.

- Achieved record revenue in the range of $95 million to $102 million in calendar year 2022, of which approximately $72 million was achieved in the six months ended December 31, 2022, a 157% increase over the results of the previous six-month period ended June 30, 2022.

- Projects cash and cash equivalents of approximately $70 million at December 31, 2022.

- Opens the 2023 calendar year with a record order backlog of approximately $159 million at December 31, 2022.

Calendar Year 2023 – Guidance

- Expected revenue in excess of $200 million, corresponding to annual growth of over 100%, with approximately 35% forecasted for the first half of calendar year 2023 and the balance in the second half of calendar year 2023.

- Expected gross margin of 10% to 12% in calendar year 2023 as the Company benefits from its manufacturing scale-up, improved product pricing, and planned product suite streamlining.

BRISBANE, Australia, January 17, 2023 – Tritium DCFC Limited (“Tritium” or the “Company”) (Nasdaq: DCFC), a global leader in direct current (“DC”) fast chargers for electric vehicles (“EVs”), today provided an update on the business.

bp Order and Market Demand

Global demand for Tritium products continues to grow, as evidenced by the latest order from bp (NYSE: BP), the Company’s largest order from a single customer in its history. This is bp’s second major order from the Company, following an initial order announced alongside the bp multi-year global framework contract in April 2022.

The size of these orders is an indicator of ongoing growth in demand for DC fast chargers, in-line with global EV uptake alongside the accelerating deployment of EV chargers by many segments including petroleum, convenience, retail, electricity, and fleet companies.

Tritium anticipates further acceleration of market demand for its high-quality and reliable DC fast chargers, which have the benefit of almost ten years of continuous operation in the field through Tritium’s large global installed fleet of DC fast and ultra-fast chargers. Tritium, an EV fast charging pioneer with a reputation as a global technology leader, estimates its position as the number two market share in the universal DC fast charger category, excluding China.

The Company expects the volume of sales to continue to grow, as customers move past pilot programs into accelerated rollouts of large, global EV charging networks. With its Tennessee factory already delivering chargers, Tritium is well-positioned to benefit from expected increases in demand for Buy America-compliant EV fast chargers from later in 2023 through 2028, driven by funding from the National Electric Vehicle Infrastructure (“NEVI”) Formula Program and the Inflation Reduction Act.

Tennessee Factory and Production Update

Tritium began its lease of a factory in Tennessee in March 2022, fit out the facility over five months with the first of six planned production lines operational in July, and held a grand opening in August. During the 2022 calendar year, the Company made meaningful upfront investments in raw materials, equipment, and the recruitment of more than 200 employees for the Tennessee facility. Tennessee will continue to scale over the course of 2023, producing the Company’s chargers at a rate of efficiency previously not achievable.

In December 2022, Tritium produced record units at both its Brisbane and Tennessee facilities, with each location contributing to the achievement of the single largest monthly output in Company history with more than 600 and 400 units, respectively. These milestones were reached by executing the Company’s plan to accelerate production rates to meet customer demand and shorten order fulfillment time to drive improved working capital efficiency and advance Tritium’s continued market leadership.

Currently, the Tennessee factory is operating two production lines with plans to add three additional lines in 2023. While demand for Tritium’s products supports an even faster factory ramp-up with additional lines and more shifts, the Company continues to balance its growth within the guardrails of working capital availability and labor recruitment in the local Tennessee market.

The Company expects to hit several global production milestones in 2023 as the Tennessee factory continues to ramp-up and production at the Brisbane factory shifts to Tritium’s new class of modular chargers. While the Tennessee factory focuses on modular charger production, Tritium remains on plan to cease production of its four legacy products at its Brisbane factory in 2023 to focus production efforts at that location solely on the Company’s in-demand, modular chargers going forward. This optimization will further drive efficiency gains across purchasing, supply chain, warehousing, production, testing, quality control, and distribution, enabling improved margins.

The production ramp-up in 2023 is expected to produce a total projected output of at least 11,000 units for the calendar year 2023. Calendar year 2024 is expected to benefit from the full year impact of 2023 initiatives: a production run rate at scale, the transition to the planned streamlined modular product suite, new products to be launched in 2023, continued improved pricing, and operational efficiencies across supply chains, logistics, and services.

Calendar Year 2023 Guidance

Tritium’s 2023 forecasts are supported by the Company’s current purchase order backlog of approximately 80% of forecast revenue for calendar year 2023, planned production line expansion at the Tennessee plant, and charging infrastructure deployment plans shared by Tritium’s blue-chip customer base. For calendar year 2023, the Company expects:

- In excess of $200 million in revenue, an increase of over 100% over unaudited preliminary calendar year 2022 revenue.

- Gross margins to improve throughout calendar year 2023, averaging between 10% and 12% over the full calendar year.

- Operational expenses, including R&D, of $90 million to $95 million, a 13% to 19% increase from unaudited preliminary 2022 calendar year operational expenses.

Tritium believes it is well-positioned to meet its 2023 forecasts despite macro-economic factors affecting the global economy, given its customer base includes well-capitalized Fortune 100 companies, fully-funded growth companies, and companies that are already accessing committed government funding. Tritium’s guidance for revenue and margin increases is enabled by planned production scale-up, production efficiencies gained through a streamlined product suite with significant parts and architecture commonality, the ability to truck chargers across the US, rather than transport them by sea or air, and pricing improvements driven by supply limitations, NEVI funding, and high inflation. The Company ordered long-lead time parts throughout the 2022 calendar year for planned 2023 manufacturing to mitigate the globally disrupted electronics supply chain.

“Tritium remains focused on maintaining and growing our enviable global fast charger market share through designing, selling, building, and servicing world-class chargers,” said Tritium CEO Jane Hunter. “2022 was a foundational year, putting many of the building blocks in place to deliver our long-term competitive strategy, while still achieving record revenue and sales. With the listing of the Company on the Nasdaq, opening the Tennessee factory, securing the world’s best customers, and rounding out our talented management team, Tritium is better positioned than ever to capitalize on the opportunities ahead.”

2022 Business Update

- The Company projects record sales orders valued at $195 million for calendar year 2022, representing a 38% increase over the $141 million of sales orders received in calendar year 2021. Based on discussions with new and existing customers, Tritium expects to have 2023 production fully allocated through committed sales orders in early 2023.

- Tritium currently expects to achieve record revenue in the range of $95 to $102 million for calendar year 2022, representing a 23% to 32% increase over revenue for calendar year 2021. Revenue for the six months ended December 31, 2022 is expected to be $72 million, an increase of 157% over the six months ended June 30, 2022.

- The Company anticipates a record year-end sales order backlog of approximately $159 million, which supports the Company’s calendar year 2023 revenue guidance.

- Cash and cash equivalents at the end of calendar year 2022 are projected to be $70 million.

Tritium enters 2023 as the only top three global fast charger manufacturer with a US factory able to take advantage of Buy America requirements. The Company’s product suite continues to sit at the forefront of the industry, with the only fully liquid-cooled, fully-sealed, and IP65-rated charger on the market, affording the Company an industry-leading total addressable market and delivering to its customers a lower total cost of ownership over the competition.

St Baker Capital Raise

Tritium also received a primary capital investment of $30 million in December 2022. This capital is made possible through a new, stand-alone $20 million working capital facility and an additional $10 million accordion, which expands the previously announced senior debt facility from $150 million to $160 million. The Company also confirms that it has not sold any securities under its previously announced $75 million B. Riley committed equity facility, and its current share count stood at 155,488,856 common shares as of December 31, 2022.

The $20 million working capital facility has been provided by Sunset Power Pty Ltd (“Sunset Power”), a trustee of the St Baker Family Trust. The $10 million accordion facility is also provided by Sunset Power and expands the previously announced debt facility agreement with long-term supporters Cigna Investments, Inc. (“Cigna”), the investment arm of Cigna Corporation, a U.S.-based global health services company, Barings LLC (“Barings”), a global investment manager, and Riverstone Energy Limited (“Riverstone”).

The capital is to be used to grow the business through increased manufacturing capacity, securing long lead-time parts, and bolstering the Company’s cash balance. These capital raises demonstrate the long-term support for Tritium by both its largest shareholder, Trevor St Baker AO, and the Company’s senior lenders.

In addition to providing capital, during the fourth quarter of 2022 the St Baker Family Trust notified Tritium that it had acquired an additional 3% of Tritium shares through market purchases, representing the maximum additional shareholder accumulation permitted under Regulatory Guide 6 of the Australian Securities and Exchange Commission (“ASIC”) addressing creeping acquisitions within takeover law, which limits additional accumulations in a six-month period by any shareholder with holdings in excess of 20% of the Company’s common shares. The St Baker Family Trust and its affiliates now own and control 24.8% of the common shares of the Company as of December 31, 2022.

About Tritium

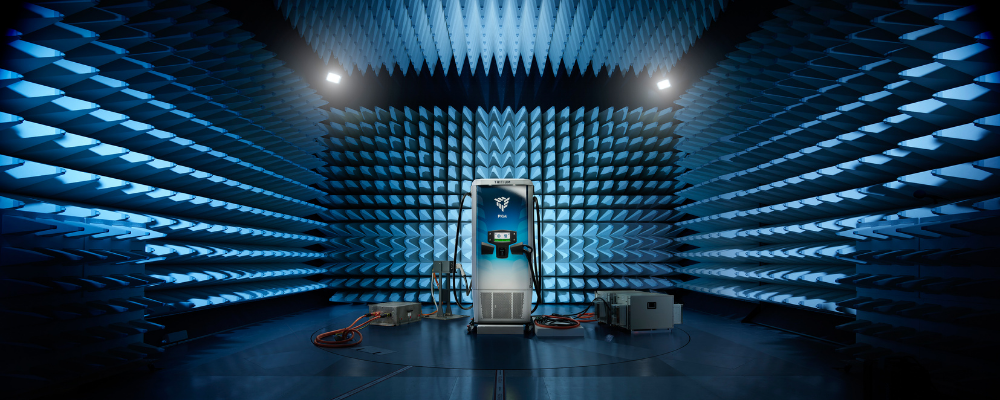

Founded in 2001, Tritium (NASDAQ: DCFC) designs and manufactures proprietary hardware and software to create advanced and reliable DC fast chargers for electric vehicles. Tritium’s compact and robust chargers are designed to look great on Main Street and thrive in harsh conditions, through technology engineered to be easy to install, own, and use. Tritium is focused on continuous innovation in support of our customers around the world.

For more information, contact us.

Presentation of Information

Unless otherwise indicated, all references herein to “year” or to a specific year (e.g., 2022, 2023, 2024, etc.) are to the calendar year. Any references herein to the Company’s fiscal year ending June 30 are described as “fiscal year” or “FY.”

Forward Looking Statements

This press release includes “forward-looking statements.” The Company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predict,” “potential,” “continue,” “aim,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations, hopes, beliefs, intentions or strategies for the future. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results, including, but not limited to: our history of losses; the ability to successfully manage our growth; the adoption and demand for electronic vehicles including the success of alternative fuels, changes to rebates, tax credits, and the impact of government incentives; the accuracy of our forecasts and projections including those regarding our market opportunity; competition; our ability to secure financing; delays in our manufacturing plans; losses or disruptions in supply or manufacturing partners; risks related to our technology, intellectual property and infrastructure; exemptions to certain U.S. securities laws as a result of our status as a foreign private issuer; and other important risks and uncertainties described in the documents filed by the Company from time to time with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Most of these factors are outside the Company’s control and are difficult to predict. The Company cautions not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. The Company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

###

Media Contact

Jack Ulrich

[email protected]

Investor Contact

Cary Segall

[email protected]