Sustainability is crucial to building a better world. During Earth Month we’re exploring ways businesses can improve sustainability through electric vehicles and electric vehicle charging.

Electrifying transportation is key to reducing greenhouse gas (GHG) emissions and mitigating the effects of global warming. According to the International Energy Agency (IEA), about 37% of CO2 emissions in 2021 came from the transportation sector. Transitioning to electric vehicles (EVs) can help reduce GHG emissions and avoid climate disaster.

But there are immediate benefits to electrifying your fleet: Switching your fleet to EVs can save you a lot of money in long-term fuel and maintenance costs, give you more control over when and where you fuel or charge up, and even help you operate in more locations across the globe.

EVs eliminate tailpipe emissions and greatly reduce GHG emissions even when they’re charged with power generated with fossil fuel powerplants. EVs are far more efficient than ICE vehicles, which means it takes less energy of any type (even fossil fuel energy) to move them. Higher efficiency means fewer GHG emissions. Additionally, it’s easier to control emissions at a few power plants than it is to control them in millions of vehicles. Lastly, EVs can also easily be powered by renewable energy sources like solar, wind, wave, and geothermal power.

Switching to EVs can also help offset your business’ carbon emissions, reducing tax burdens and helping to avoid any future penalties or fines for carbon emissions.

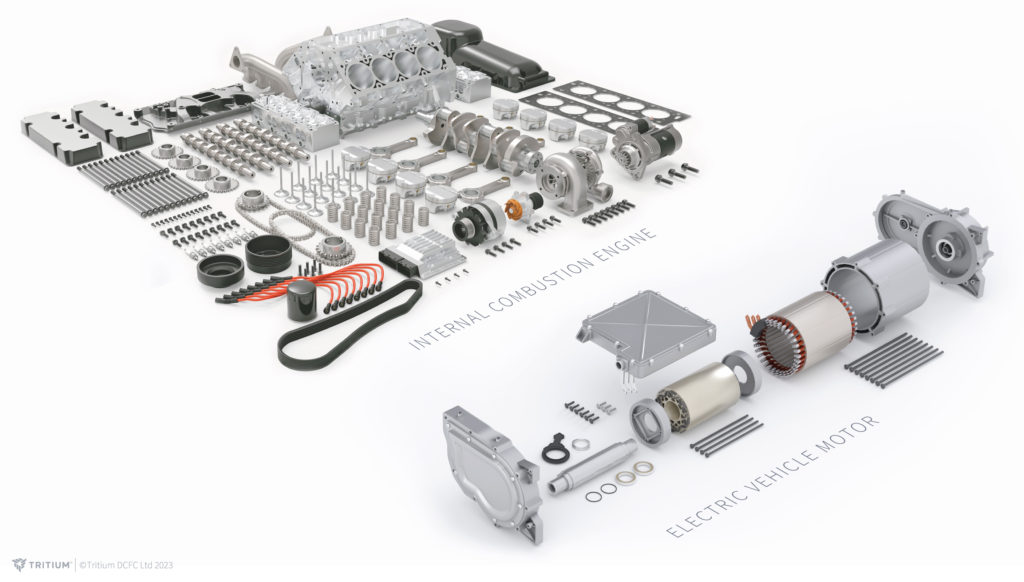

EVs are inherently less complex than ICE vehicles. According to a recent Forbes article, the typical internal combustion engine (ICE) drivetrain has about 2,000 moving parts while a typical EV’s drivetrain has about 20. And because EVs have fewer moving parts, it’s estimated their drivetrains (motors and transmissions) should last much longer than their ICE counterparts. Many EV drivetrains are engineered to run for up to 500,000 miles without service.

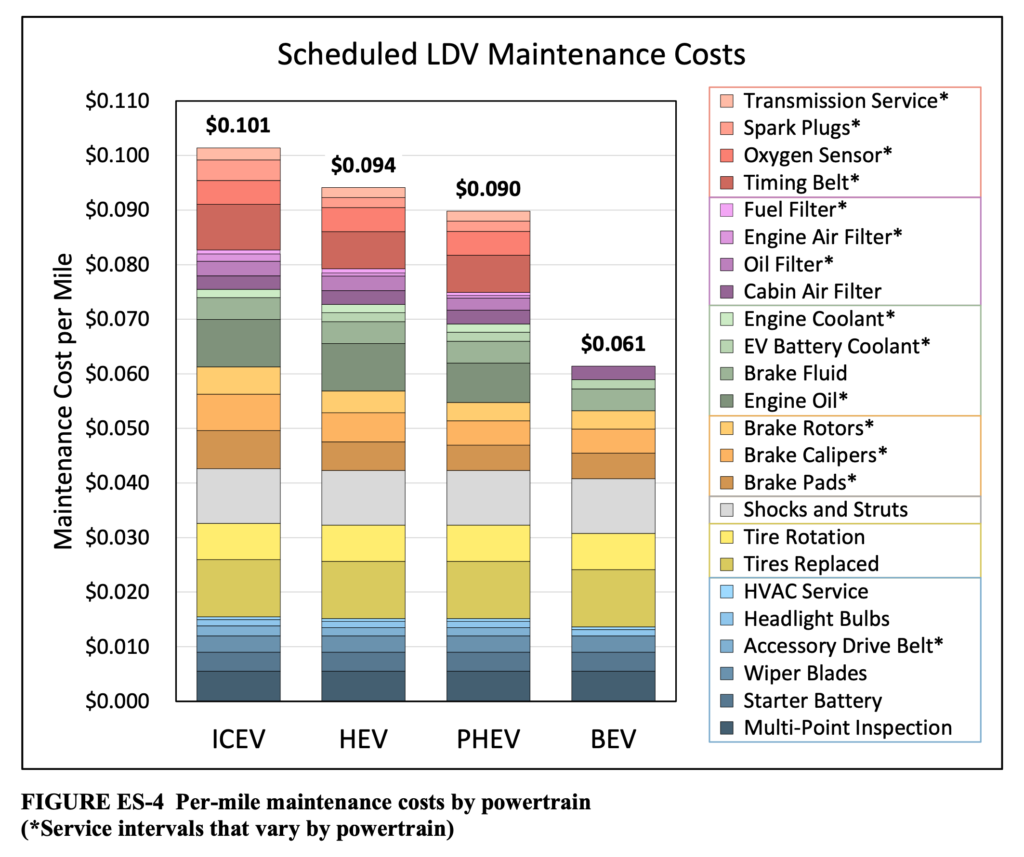

According to a study by the US Office of Energy Efficiency and Renewable Energy, the estimated scheduled maintenance costs for ICE vehicles is approximately 10.1 cents per mile compared to just 6.1 cents per mile for EVs.

According to Consumer Reports, EV drivers pay half as much for repairs and maintenance. Consumer Reports also found that EV drivers can expect to save an average of $4,600 in repairs and maintenance over the life of the vehicle.

More research by the Department of Energy’s Argonne National Laboratory found that EV maintenance costs are 30% lower than ICE vehicles.

Diesel and gasoline prices fluctuate wildly, but they have steadily rose over time and are subject to large price increases due to conflicts, natural disasters, and political turmoil. These events often have more of an effect on fossil fuel prices than electricity prices. And while electricity prices have risen significantly in Europe, they are still lower than the price of gas or diesel when used for transportation. A recent study by Dutch automotive lease provider Leaseplan found that despite energy price inflation, “fuel costs remain significantly lower for electric cars than petrol and diesel cars: fuel costs represent 15% of the total cost of ownership of an EV, while this is 23% and 28% for petrol and diesel drivers.”

EVs will almost always have lower fuel costs than ICE vehicles because they are more efficient. According to Motortrend Magazine, between 74 and 84 percent of the energy contained in gasoline is lost to heat and friction in an ICE vehicle. If you were to spend €1.80 on a liter of gasoline, only €.36 worth of it is used to move your vehicle. In comparison, only 31-35 percent of the energy in an EV’s batteries is wasted: 10 percent of the source energy from the grid lost in the charging process, 18 percent lost to the drivetrain motor components, up to 4 percent lost to auxiliary components, and another 3 percent lost through powertrain cooling and other vehicle systems.

ICE vehicles rely on networks of fuel stations that may or may not be near your established routes. If you build your own charging network, EVs give you the freedom to charge up when and where you want. Installing EV fast chargers at your offices or distribution centers can:

EVs can charge up overnight and run all day. Amazon plans to deploy a fleet of more than 100,000 EVs for last-mile, in-town deliveries by 2030. The retail giant will use Rivian delivery trucks and trucks from other manufacturers for deliveries across the world. Amazon expects the trucks to run for 12 hours a day and to charge up using DC fast chargers at Amazon distribution centers. The vans are expected to have a 300,000-mile lifespan before major maintenance, greatly reducing total cost of ownership. With these Rivian vans and DC fast charging at its distribution centers, Amazon can eliminate fuel stops and reduce downtime during operating hours.

Many governments around the world are offering financial incentives to make the switch to EVs. Nearly every country in Europe also offers some form of incentive to purchase EVs and EV charging equipment. The European Automobile Manufacturer’s Association (ACEA) has compiled a comprehensive list of EV incentives by European member countries. Many countries are offering thousands to offset the cost of new EVs, and most also offer incentives to purchase EV charging equipment. For example, France is offering up to 40% off the purchase and installation costs of EV charging points for businesses and public entities. There are also many other regional and city incentives available throughout Europe.

In the United Kingdom, the government offers up to £2,500 in incentives for the purchase of a new electric car. Additionally, the UK government has approved £30 million of funding in 2022 to 2023 for fast charging infrastructure, including DC fast chargers. The UK government is authorizing up to £13,000 in grant money per public charge point.

In the US, many states offer tax credits for electric delivery vehicles, and the $1.2 trillion Bipartisan Infrastructure Law includes $5 billion to help states build extensive EV charging infrastructure. There are also many state and regional incentives in the form of tax credits or grants available in the US. You can read more about them in our article here.

In Australia, the Treasury Laws Amendment (Electric Car Discount) Bill provides $2000 off the price of battery-electric and plug-in hybrid vehicles (PHEV). The bill also delivers Fringe Benefits Tax (FBT) exemptions for fleets and novated leases. Australia also raised the Luxury Car Tax threshold for low-emission vehicles to $84,916, from $71,849. The FBT savings amount to about $4700 for an individual.

Our experts can help you plan your fleet’s transition to electric vehicles. Our experts have decades of experience helping logistic companies, public transportation agencies, trucking companies, and rideshare companies integrate EVs and EV fast charging into their business models.

Electric trucks and vans are quiet, reliable, and clean. They make our cities quieter, cleaner, and healthier. That’s why US federal, state, and even city governments have created multiple incentive programs for businesses to make the switch. Many states offer tax credits for electric delivery vehicles, and the $1.2 trillion Bipartisan Infrastructure Law includes $5 billion to help states build extensive EV charging infrastructure. Whether you’re a business or state or local government agency, now is the perfect time to take advantage of incentives to build your electric fleet—and you can rest assured that the public charging infrastructure will be there to support it.

Before you electrify your fleet, you’ll need a plan to determine what kind of charging infrastructure you need.

First, start with site design. Every business will have different vehicles, site configurations, drivers, and needs. Ask the following questions:

These questions and others will form a brief to help you truly understand what your goals are.

Once you’ve determined your site design, look at charging hardware. With a good understanding of how you’ll use your vehicles, you should have an idea of the types of charging speed you’ll need. If your vehicles will be charging up for several hours, you won’t need ultrafast DC chargers. If they need to make frequent trips, like rideshare services, ultrafast charging may be necessary.

Lastly, look at ways to reduce capital expenditure. There are many funding programs through governments, utilities, air pollution control districts, and more to help you save on fleet electrification. Also focus on total cost of ownership. Consider site construction costs, maintenance, upkeep, etc.

We’ll review several types of incentives in this article:

An EV tax credit is an incentive to encourage businesses and organizations to purchase or lease electric vehicles. Fleet owners typically lease their vehicles but can still take advantage of tax breaks.

Fleet EV incentives are available through:

The Inflation Reduction Act (IRA) is a bill that provides nearly $370 billion for climate change initiatives to help reduce carbon emissions by roughly 40 percent by 2030. It provides significant tax breaks for businesses who purchase new medium and heavy-duty electric vehicles and new chargers.

The Clean Commercial Vehicle Credit lets business claim up to 30% of the purchase price (up to $40,000) of a new medium or heavy-duty commercial EV that weighs more than 14,000 pounds, which is vehicles that fall into classes 4 and above.

There are hundreds of incentives available for fleet owners in the US. Every state has multiple programs to help transition fleets to electric power, and some power companies also offer help. At first glance it can be confusing, but there are many resources to help you sort it out. If you need more help finding incentives in your area, reach out to one of our experts.

The Alternative Fuels Data Center (AFDC) has made finding state laws and incentives for EVs and alternative-fuel vehicles simple. Just visit the site and click on your state to see a list of available incentives. The site is kept up to date and has all the latest news about rebates, tax breaks, and grants.

California is leading the charge with 168 programs, Washington comes in second with 67, and New York third with 56 (at the time of publication). But all states in the nation are offering something to help transition to electric commercial vehicles. Alabama is offering grants for charging stations and medium/heavy duty electric vehicles. Illinois is offering grants to cover up to 80% of the cost for the installing and maintaining direct current (DC) fast chargers, like Tritium’s PKM150. Colorado is offering similar grants that fund 80% of the cost of many EV charging stations, including up to $50,000 for a 100kW or higher charger.

Those are just a few of the grants and programs available for businesses looking to electrify their fleets. Dive into the AFDC site to find programs for your area and contact one of our experts if you have questions about DC fast chargers or charging infrastructure.

Environmental Protection Agency (EPA) SmartWay Heavy-Duty Truck Electrification Resources

The EPA has compiled an exhaustive list of resources for US businesses or organizations looking to electrify their fleets. The organization has included links to incentive programs along with total cost of ownership (TCO) calculators so you can determine how much you’ll save by going electric. Here are some highlights.

The EPAs site has a wealth of information about transitioning your fleet to EVs.

Inflation Reduction Act Alternative Fueling Credit

The Alternative Fueling Credit is a general business tax credit for any company or organization that installs DC fast charging stations. It will offset up to 30% of the total costs of purchase and installation of charging equipment, up to $100,000 per charger. The credit cannot be used to offset expenses related to permitting and inspection. The tax credit can be used anywhere in the US and can be applied after receiving other EV grants or rebates but can only to the charger costs not covered by those grants or rebates. Resellers may claim this credit even if they’re selling charging equipment to a tax-exempt organization (nonprofit), government organization, or foreign entity (state or local government/tribes), but they must disclose in writing the amount of the credit. Tritium chargers, including the RTM and PKM150, qualify for the Alternative Fueling Credit.

Some US power companies offer incentives for businesses electrifying their fleets. California’s Pacific Gas and Electric Company (PG&E) offers a $9,000 rebate for transit buses and trucks that weigh over 33,000 pounds. They also offer $4,000 rebates for local delivery trucks. The company also offers up to a $42,000 rebate for 150kW and above chargers. The company will also help with site design and permitting, construction and activation, and maintenance and upgrades. There are some requirements, including:

View PG&E’s EV Fleet Program page for more information.

Many other electric companies offer services to help you transition your fleet to electric. Check with your local power company to see what programs are available.

Finding the right incentives to transition your fleet to electric can be a complicated process. And if you don’t find all the available incentives in your area, you’ll miss out on significant savings. To make sure you take advantage of all the incentives and programs you can, contact one of our experts. We can help you find those incentives, plan your charging site, and choose the proper chargers for your needs.